Table of contents

- What is Venture Capital?

- History of venture capital

- Venture Capital Funding Stages

- 9 major venture funds in the crypto market

1. What is Venture Capital?

Venture Capital (or VC) are venture capital funds that specialize in providing capital, sometimes investment capital and professional support to startups or small projects that want to scale but don't have enough money. financial potential.

The goal of this investment is to redeem a share in the project or gain the right to buy the token early at a low valuation and expect it to increase in price in the future.

Venture capital funds are often formed as limited partnerships (LPs) where private partners invest in VCs. Wealthy individuals, insurance companies, pension funds, hedge funds, corporate funds, etc. can pool money together into a fund controlled by a VC firm. All partners have partial ownership of the fund, but the VC firm itself controls where the fund is invested.

Venture capitalists often look for projects with strong management teams, large potential markets, and unique products or services with a strong competitive advantage. They also look for opportunities in industries they are familiar with and the chance to own a large percentage of the project so they can influence its direction and development.

2. History of venture capital

Venture Capital first appeared in the United States in the mid-twentieth century. Georges Doriot, a Frenchman who moved to the United States to earn a business degree, became a lecturer at Harvard's business school and worked at an investment bank. He went on to found what would become the first publicly traded venture capital firm - American Research and Development Corporation (ARDC) in 1946.

ARDC resonates in being the first time a startup can raise money from private sources, not wealthy families. In the past, new companies looked to wealthy families like the Rockefellers or Vanderbilts for the capital they needed to grow. ARDC soon had millions in accounts from educational institutions and insurance companies. Firms such as Morgan Holland Ventures and Greylock Partners were also founded by ARDC.

In essence, venture capital is investing in new business areas that have high growth potential but also have a large enough level of risk, so it often makes banks - which prefer safety, fear.

So it's not too surprising that Fairchild Semiconductor (FCS), one of the first and most successful semiconductor companies, was the first venture-backed startup, creating a template for venture capital's close relationship with emerging technologies in the San Francisco Bay Area.

Venture capital has since flourished, becoming a hundreds of billions of dollars industry, with a record total of $330 billion in investments worldwide by 2021.

3. Venture Capital Funding Stages

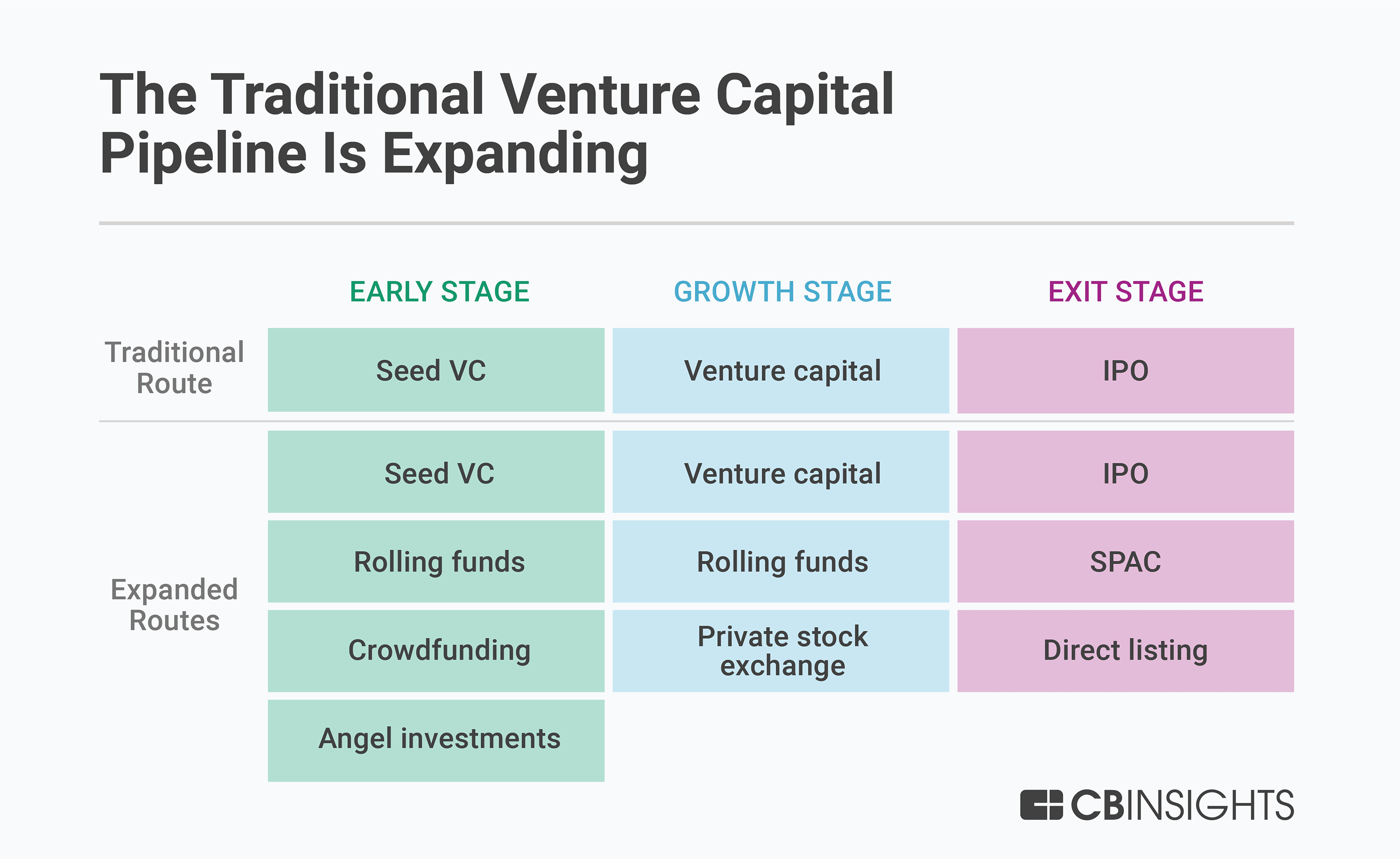

In general, the main goal of VCs is to find a way to increase the return on their investment by investing in a project early. Before investing in that project, they need to look at different projects by assessing their growth potential and potential return on investment. VC funds spread their investments to mitigate potential downside and volatility risks.

Standard VC funding is typically invested in five phases:

- Pre-seed Round: The project is at a very early stage (usually just an idea) and investments often come from family, friends,...

- Seed Round: Product is testing its viability, including market potential analysis, competitor analysis and development of a minimal viable product. At this stage, the whitepaper, cash flow, roadmap and other documents are used to attract and find potential investors.

- Series A: Product is validated, in development and supported by a strong community. Investing at this stage is less risky for investors, but often more expensive and focuses more on marketing and advertising.

- Series B: The product now has a large number of users and the project is expanding. Mobilizing investment capital at this time is mainly for marketing, sales, human resource development, business development and customer service,...

- Series C: Focus on diversifying product lines and accessing international markets.

However, funding crypto projects is a bit different, usually wrapped in 3 rounds, including:

Seed Sale: This stage is similar to Seed Round in traditional VC, when the new product is just an idea on paper.

Private Sale: Usually at this stage, the project has a whitepaper, roadmap, product outline, etc. Private Sale is usually held in private for some special guests. After the private sale, if the project wants to raise more capital, there may be Series A, B, and C rounds.

Public Sale: This is the fundraising phase when everything is complete and the project is ready to introduce itself to retail investors and users.

The reason is because most crypto projects usually only last a fairly short time, complicated technology requires a lot of effort and time, the development team is not motivated to maintain the project, etc. Therefore, the project may not last too long to raise capital as many times as the traditional market.

Therefore, most crypto projects will raise VC capital in rounds of Seed Sale (Genopets, DareNFT,...), Private Sale (Solana, Avalanche,...). Projects that can survive and thrive through this phase will continue to be able to raise capital in Series A (Praxis, Rarify) and Series B (Dune Analytics, Palm NFT Studio) rounds. Only a few companies with real potential and strong development like FTX are able to raise capital in the Series C round.

How risky is venture investment?

VCs are willing to risk investing in such projects as they can earn great returns on their investment if these projects are successful.

However, VCs also have a fairly high failure rate due to the uncertainty associated with the success of new projects. That means VC funds can lose all the money they have invested in them. A general rule of thumb is that three or four out of every 10 startups fail.

Besides, because they often invest in projects very early, even when the project is just an idea, there is a whitepaper but no actual product, so VC funds can also encounter scams. The scam here is not only a fraudulent project, embracing all investors' money and then running away, but also the project's failure to comply with the commitments and roadmap outlined when calling for capital.

For example: When calling for capital, the project commits to have a product after 6 months, and in the next 3 months, it will reach a certain user milestone. After successfully raising capital, the project worked slowly, without significant progress for a long time, causing VCs to be buried.

4. 9 major venture funds in the crypto market

Several hedge funds have emerged as the top crypto VC funds over the past few years.

Three Arrow Capital

Founded in 2012 by Su Zhu and Kyle Davies, Three Arrows Capital is considered one of the leading venture capital funds and market makers in the crypto space.

Three Arrow Capital holds shares of several major blockchains such as Ethereum, Avalanche, Bitcoin, Polkadot, Terra, Solana and many more. They also have investments in several DeFi and GameFi projects such as Axie Infinity, Aave and countless others.

Three Arrow Capital also invests in equity-based blockchain projects. For example, the Fund has stakes in BlockFi, Deribit, and Starkware.

a16z - Andreessen Horowitz

Founded in 2009 by Marc Andreessen and Ben Horowitz, Andreessen Horowitz (commonly known as "a16z") is a crypto VC firm based in Menlo Park, California.

Like Three Arrow Capital, a16z has stakes in many top crypto projects like Coinbase, Celo, MakerDAO and many more.

In June 2021, the company raised a $2.2 billion fund to support blockchain-focused startups.

Alameda Research

Alameda Research is a cryptocurrency investment fund founded by the founder of FTX exchange - Sam Bankman-Fried and currently headed by Sam Trabucco.

Alameda Research also has stakes in most of the major blockchains and blockchain projects, including Bitcoin, Ethereum, Binance, Solana, Uniswap, and countless others.

Coinbase Ventures

Coinbase Venture is always among the top participants in raising capital in the market.

Coinbase Ventures is the investment arm of Coinbase, a popular cryptocurrency exchange. While several other VC funds have invested in Coinbase, Coinbase Ventures itself is an investor in projects like BlockFi, Compound, Starkware, and many more. You can see a more detailed overview of the Coinbase Ventures fund and their portfolio here.

Binance Labs

Binance Labs belongs to Binance - another famous exchange. Binance Labs leverages Binance DEX to invest in new crypto projects and their portfolio includes Terra, Moonbeam, and Coin98 among others.

Paradigm

Paradigm is a venture capital fund that supports crypto companies with holdings ranging from $1 million to $100 million. They follow a "flexible, long-term, multi-stage and global" approach to crypto investing, helping projects answer technical and operational questions. Paradigm's portfolio includes Argent, Optimism, Opensea,...

Multicoin

Multicoin is a "company that specializes in investing in cryptocurrencies, tokens and blockchain companies." They are a crypto-base fund engaged in staking, liquidation and other crypto-currency activities. Their portfolio includes Audius, Arweave, Near Protocol,...

Pantera

Pantera bills itself as "the first US asset manager to focus entirely on blockchain." Since 2013, Pantera has invested in essential blockchain infrastructures such as exchanges, custodians, institutional trading tools, decentralized finance and more. Their portfolio includes Coinbase, FTX, Polkadot,...

Polychain

Polychain is a VC focused on blockchain-based digital assets. Their most notable investments are in Acala, Celo, and dYdX. Through many different investments, Polychain Capital has close relationships with many large funds in the crypto market such as a16z, 3AC, Coinbase, ... and many others.