Is BrightenLoans a Scam? Unveiling the Loan Connection Service

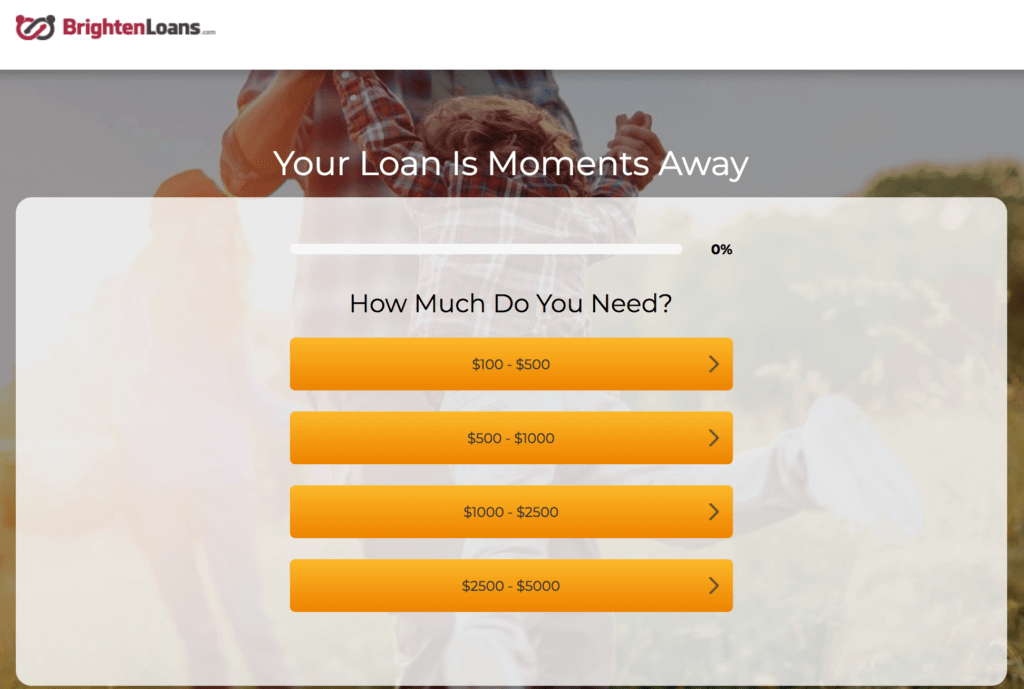

BrightenLoans positions itself as a helping hand, connecting borrowers with potential lenders. While they present a user-friendly website with a privacy policy and terms of service, there are reasons to be cautious before using their service.

BrightenLoans information

Limited Transparency Raises Concerns

While BrightenLoans seems legitimate on the surface, a closer look reveals a lack of transparency that raises concerns. One major red flag is the limited contact information they provide. Without a clear way to reach them directly, it becomes difficult to address any questions or issues that might arise.

Perhaps more importantly, BrightenLoans remains opaque about the network of lenders they connect borrowers with. This lack of clarity extends to crucial details like interest rates and loan terms. The concern is that BrightenLoans might connect you with payday lenders, notorious for charging excessively high-interest rates and saddling borrowers with debt.

Exploring Alternatives: Finding the Right Loan

While BrightenLoans itself might not be a full-fledged scam, the secrecy surrounding their lender network highlights the importance of borrower due diligence. Here are some steps you can take to be a savvy borrower:

-

Independent Lender Research: Don't depend solely on BrightenLoans' connections. Take the initiative to research any lenders they recommend. Look into their interest rates, loan terms, and reputation with organizations like the Better Business Bureau. Don't hesitate to reach out to the lenders directly to ask questions and get clarification on any uncertainties.

-

Consider All Loan Options: Broaden your horizon and explore alternative loan options. Consider personal loans from banks or credit unions. These institutions often provide more competitive interest rates and clearer terms compared to payday lenders. You might also qualify for government-backed loans or hardship programs depending on your situation.

-

Financial Planning for the Future: Consider this a wake-up call to improve your financial literacy. Look for ways to create a budget and build an emergency fund. This will help you avoid situations where you might need to resort to quick loan solutions with potentially negative consequences.

The Takeaway: Be a Proactive Borrower

BrightenLoans might seem like a convenient solution, but it's crucial to approach their services with caution. Instead of relying solely on their connections, invest time in researching lenders and explore alternative loan options. By being a proactive borrower and taking control of your financial well-being, you can secure financing that best suits your needs without getting caught in a cycle of debt. Remember, with a little planning and research, you can find the right loan solution that helps you move forward, not backward.