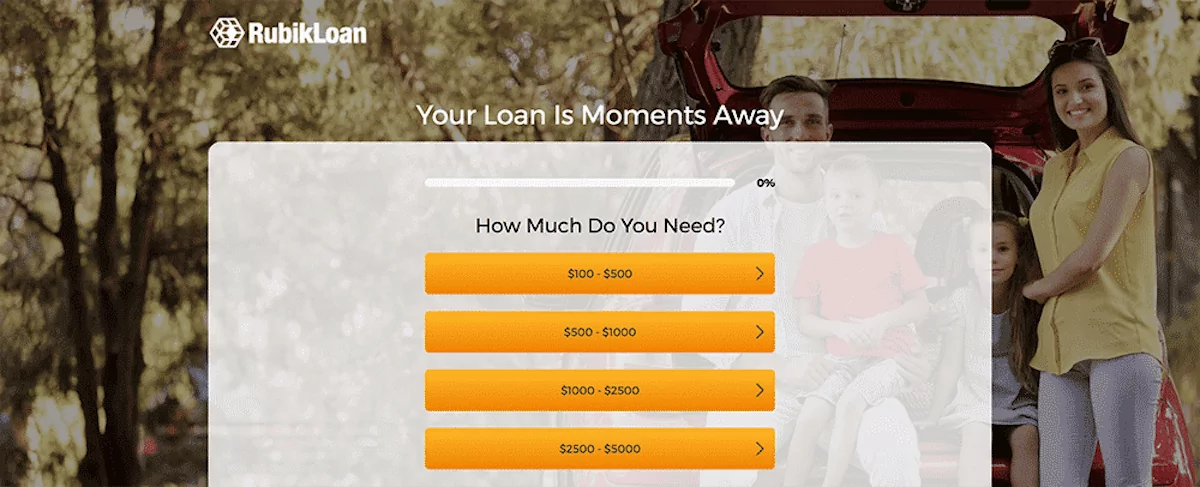

RubikLoans: Solving Your Cash Crunch or Creating a New One?

RubikLoans advertises itself as a quick and easy solution for financial needs, promising to connect borrowers with lenders offering fast cash. However, before you dive into their application process, a closer look is essential to ensure you're not navigating towards a financial labyrinth.

RubikLoans information

Red Flags and Potential Challenges

While RubikLoans might appear convenient, there are reasons to be cautious. One alarming sign is the potential lack of transparency regarding the lenders they connect borrowers with. A reputable service would openly disclose its partnered lenders and their loan terms. Without this crucial information, it's impossible to assess the true cost of borrowing. There's a chance RubikLoans might connect you with payday lenders. These lenders are known for charging excessively high-interest rates and short repayment terms, which can quickly trap borrowers in a cycle of debt. The high-interest rates can quickly snowball, turning a small loan into a massive financial burden.

Another concern is the potential difficulty reaching RubikLoans' customer service. If you encounter issues or have questions about your loan agreement, a company with responsible practices should offer accessible customer support channels. Limited contact options can be a red flag, hindering your ability to address concerns and potentially leaving you without assistance if you encounter problems.

Finding Safe Alternatives: Responsible Loan Options

Instead of potentially risky services like RubikLoans, consider these alternatives to secure financing responsibly:

-

Research Reputable Lenders: Don't solely rely on RubikLoans' network of lenders. Take the initiative to research established institutions such as banks and credit unions. These institutions typically provide clear loan terms with competitive interest rates. Look for lenders insured by the Federal Deposit Insurance Corporation (FDIC) for added security. Online lenders can also be an option, but make sure to thoroughly research their reputation and customer reviews before applying.

-

Explore Loan Options Beyond Payday Loans: Broaden your search and consider alternatives to payday loans. Depending on your circumstances, you might qualify for government-backed loans or hardship programs that offer lower interest rates and more manageable repayment plans. These programs are designed to assist borrowers in need and come with terms that are significantly more favorable than those offered by payday lenders. Peer-to-peer lending platforms or personal loans from banks or credit unions are also worth exploring. These lenders typically conduct a more thorough credit check, resulting in a more personalized interest rate and potentially lower rates for borrowers with good credit.

-

Financial Literacy is Key: Use this as an opportunity to focus on your financial well-being. Learn effective financial management strategies. Creating a budget and building an emergency fund can significantly reduce situations where you might need to resort to quick cash solutions with potentially negative consequences. There are many free financial resources available online and through community organizations to help you on this path. You can learn about budgeting techniques, debt management strategies, and how to build a strong financial safety net.

-

Seek Help From Credit Counselors: If you're struggling with debt, don't hesitate to seek assistance from a reputable credit counseling agency. These organizations provide free financial advice and can help you develop a plan to manage your debt and improve your credit score. Credit counseling agencies can help you negotiate with creditors, consolidate your loans, and create a realistic repayment plan to get you back on track.

Conclusion: Prioritize Financial Wellness Over Instant Solutions

RubikLoans might seem like a quick fix, but prioritizing responsible borrowing practices is crucial. By researching lenders, exploring alternatives, and focusing on financial literacy, you can secure the financing you need without falling prey to predatory loan terms. Remember, with a little planning and financial empowerment, you can find a loan solution that supports your long-term financial goals and overall well-being. Don't be lured by the convenience of instant cash; invest the time to find a loan that fits your needs and budget without putting your financial future at risk.