Liquidity (aka liquidity) has a very important role in any investment sector, including cryptocurrency investing. Because without good liquidity, it will be difficult to invest and buy coins in the crypto market.

Table of contents

- What is Liquidity?

- What effect does Liquidity have on the Crypto market?

- Liquidity's Role for Crypto Investors

- What Factors Affect Liquidity in Crypto Market

- How to recognize the Liquidity of Cryptocurrencies

- Top 5 coins with high Liquidity

1. What is Liquidity?

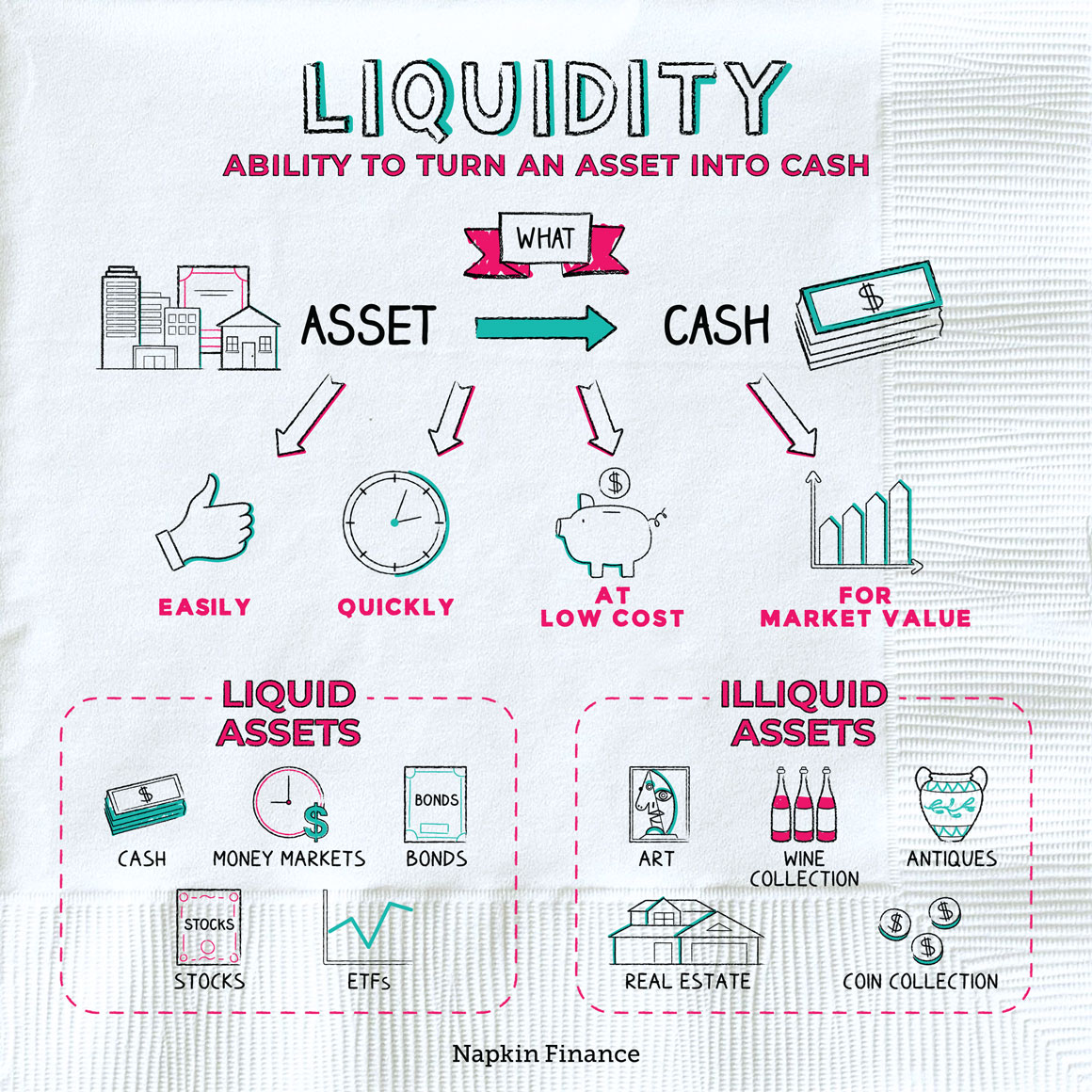

Liquidity - Liquidity is understood as the level of buying or selling quickly of an asset (including trading coins) but does not affect the overall price stability. This means that the asset is converted to cash in a favorable way to satisfy the owner's need. Therefore, cash is the measure used to assess the liquidity problem of assets.

A highly liquid asset is that it must be available to trade in all the world's markets at a stable price. In contrast, illiquid assets are often not traded on major exchanges but only in private exchanges. So, the easier an asset is to convert to cash, the more liquid it is, and vice versa. When converting an asset, its price will never change and it will take a certain time.

2. How Liquidity Affects Crypto Market?

Liquidity plays an extremely important role in the investment and trading market of coins. When a cryptocurrency investor wants to buy or sell a certain coin, it will be done quickly and easily without waiting for a long time. In order to do that, the market must have high liquidity, many active transactions, and with that, the price difference between buy and sell orders is not too large.

In fact, not all crypto exchanges have high liquidity today. Some cryptocurrency exchanges have a trading volume of billions of dollars per day, while others are only a few thousand dollars. Besides, cryptocurrencies with high liquidity like Bitcoin or Ethereum are always traded quickly, but there are also currencies that are difficult to liquidate.

So, if you invest in a trade coin and fall into a currency with illiquidity, it will be difficult to get out at the price you want. That is the reason why investors (investors) buying and selling coins always consider and calculate to choose a currency with high liquidity and quick profit.

3. The Role of Liquidity for Crypto Investors

Stable price and suitable for the masses

A crypto investment market with good liquidity ensures stable prices and ensures fairness for all participants, including buyers and sellers. Accordingly, the seller of the coin will sell at a competitive price to make a profit, and the buyer can pay a higher price for that coin depending on their rating. As a result, the market price will be balanced and the interests of all participants will be guaranteed.

Liquidity makes the market more stable

The market has high liquidity, prices will be stable and less affected by large transactions. As a result, the market will not be manipulated or influenced by large cryptocurrency investors to make a profit. For markets with illiquidity, it is easy to be volatile by large transactions and exposes small investors to risk. Meanwhile, the markets with good liquidity will withstand many large transactions and investors can participate with confidence.

Speed up the transaction

We all know that in the highly liquid trading coin market, trading transactions are done quickly and easily. This is because the market is always stable and there are many people participating in the transaction. Cryptocurrency investors can conveniently enter or exit positions to profit, even in fast-paced market conditions. This is very important for crypto investors who are implementing day trading or scalping strategies.

Increase accuracy in technical analysis

This is obviously an issue that we cannot fail to mention when analyzing the role of liquidity in the crypto investment market. Technical analysis is a method that every investor needs to use when buying and selling coins. Technical analysis uses historical price information to build chart patterns and predict future trends. Therefore, a coin with good liquidity, stable price will help investors buy and sell coins with more accurate analysis and more accurate predictions.

4. What Factors Affect Liquidity in the Crypto Market?

Volume of the transaction

If we want to know if a market is highly liquid or not, then perhaps just trading volume statistics. A market with a lot of people buying/selling coins means that the market is liquid. Trading volume is usually reported in the past 24 hours. And investors should rely on that to consider and evaluate the market.

Choose the right exchange

As mentioned above, there are many active exchanges and trading platforms in the cryptocurrency investment market today, but not all exchanges have good liquidity. Therefore, before deciding to invest in trading coins, you should learn and choose for yourself an exchange or trading platform with high liquidity so that buying and selling coins is quick and convenient. Exchanges with a large trading volume, many participants will help promote liquidity, and you should prioritize choosing this exchange.

The consensus of the majority

Any asset class that wants to have high liquidity requires mass acceptance and cryptocurrencies are no exception. Cryptocurrency was introduced to the market in 2009 and so far has received the attention and participation of many people, from individuals to organizations.

Cryptocurrency investment is being considered as one of the effective investment methods because it brings fast profit value. Bitcoin and some other cryptocurrencies are also commonly used in online transactions. Financial experts predict cryptocurrencies to be the future of mankind.

Legal corridor

The regulatory framework has an important impact on the liquidity of any market. In developed countries, cryptocurrencies are built by public authorities with a strict regulatory framework to help promote the liquidity of the trade coin investment market. However, there are also some countries that consider cryptocurrencies as new and unrecognized currencies. Therefore, the liquidity of this market is still limited.

Other conditions

Some conditions such as economic crisis, changes in political institutions, etc. also affect the liquidity of the cryptocurrency investment market. In fact, when the world has a financial crisis, investors will worry and find all ways out of the investment market to buy and sell coins. ro.

5. How to recognize the Liquidity of Cryptocurrencies

According to experts, to know the liquidity of a cryptocurrency needs to be based on the following factors:

- Volume of transactions in 24 hours: As we know, the higher the trading volume, the more liquid the cryptocurrency is.

- Gap between bid and ask price: A short price gap reflects that the currency has stable liquidity.

- The depth of the order book: The order book is only a reference factor because the order book does not always reflect accurately. In fact, the order book depends on factors such as stop orders or "iceberg" orders. These types of orders are usually automatically placed by trade coin investors, so they are only displayed when the specific conditions are met.

Liquidity is very important. It contributes to deciding whether your investment in buying and selling coins is effective or not. It is necessary to consider carefully before deciding to buy and sell a certain cryptocurrency.

6. Top 5 coins with high Liquidity

"Choose a coin with good liquidity, Trade coin with high efficiency"

Trade coin investment should not choose a currency with low liquidity. Because when you need to sell, it will be difficult for users to make transactions. More importantly, when you see the price of the currency you are holding increases but cannot sell to take profit because the number of buyers is small. In case the price drops, the chances of that coin selling are obviously lower. That's why you should choose a highly liquid cryptocurrency.

Top 5 coins with high Liquidity

2021 is the year the cryptocurrency investment market develops quite strongly. Accordingly, the prices of several cryptocurrencies are constantly making new highs. Here are some highly liquid coins you can refer to to invest in 2022:

- Bitcoin (BTC).

- Ethereum (ETH).

- Terra (LUNA)

- Solana (SOL)

- XRP (XRP)

Note: This is just a suggestion, you need to learn about that coin. In addition, you are solely responsible for your own investment decisions.