DCA is one of the quite popular investment strategies in the crypto market in particular and the financial market in general. Join Remitano to learn about how to apply the price averaging (DCA) strategy in crypto investing through the article below!

Table of contents

- What is DCA?

- The DCA formula calculates the average price

- Principles of the DCA method of price averaging in investing

- DCA Pros and Cons - Price Averaging Strategy

- 2 effective crypto DCA price averaging strategies

- How to apply price average DCA when investing in Crypto in detail

- Specific examples of how to apply DCA price averaging in crypto

- 3 points to keep in mind when using the DCA price averaging strategy

- Frequently asked questions about DCA in coin investment

1. What is DCA?

2. The DCA formula calculates the average price

Average purchase price = (Old purchase price x number of coins/tokens purchased for the 1st time + new purchase price x number of coins/tokens purchased for the second time +...+ new purchase price x number of coins/tokens purchased for the n time): total amount of coins/token purchased.

For example:

September 11, 2022: You buy 1000 USDT for 1$

September 20, 2022: You buy another 1000 USDT for 0.5$

Total amount of USDT purchased is 2000

Average purchase price = (1000 x 1 + 0.5 x 1000 ) : 2000 = $0.75

3. Principles of the DCA method in investing

Firstly, DCA is a strategy for Holder

Second, with DCA strategy you need to invest many times

As in the example above, we had two purchases of BTC at two different times with two different prices. If you buy only once, it will not be possible to form a price averaging strategy.

This strategy is only really effective when you are entering a coin that has a short period of downtrend or is about to support the area. This will ensure that future purchases will cost less than the previous one to accumulate assets intelligently.

If you only listen to it, you will find this strategy quite easy to apply. However, in reality, there are many different ways to apply it. In the next part of this article, I will show the two most basic ways of this strategy. It is used by most investors at Remitano in daily trading to make a profit.

4. DCA Pros and Cons - Price Averaging Strategy

Advantages of the DCA . strategy

Risk reduction: DCA strategy helps investors reduce risk and preserve capital by dividing investments. Provides more liquidity and portfolio management. A falling market is seen as an opportunity to buy. Therefore, DCA can boost the profit potential as a long-term investment at a time when prices start to rise again.

Optimum Investment Cost: When you buy an investment position at a cheap price, the higher the rate of return when the price recovers or grows. Predicting future market movements is not easy, the DCA Strategy will help you with enough capital to buy the cheapest positions possible.

Limit emotional investing: The obvious difference between a seasoned investor and a beginner is a solid mentality when it comes to action. Using DCA in trading will leave you psychologically unaffected by price fluctuations. This is the mistake that most new investors make.

Disadvantages of DCA strategy

Low profit: The benefit if it is safe will not be high, this is a safe trading method for new investors. So great benefits will hardly appear when using DCA. The nature of DCA only helps you limit your losses, but if you have just joined, not losing is already very lucky.

5. 2 effective crypto DCA price averaging strategies

#1. DCA strategy to periodically invest

Cons: The biggest barrier of this form is that you have to be a "hard-handed" Holder.

When to apply the periodic investment strategy: This form as mentioned above is suitable for investors in the form of Diamond hands. In addition, to do this, you need an effective capital management and allocation strategy. If you do not prepare a good enough cash flow, you can break the load midway at any time.

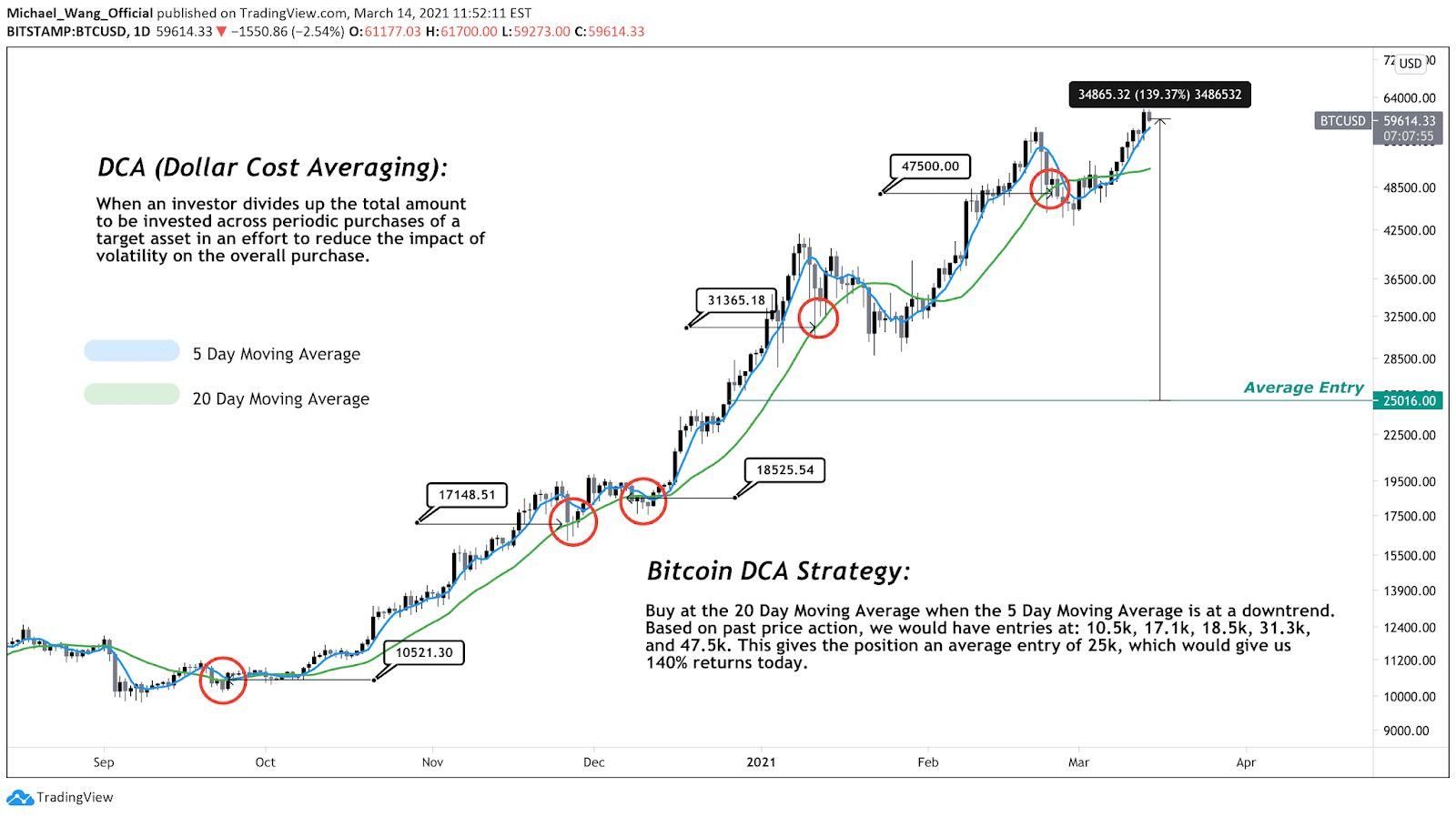

#2. Price tracking and averaging - DCA in the right moments

Compared to the above form, this second option is somewhat more subtle. Instead of continuously buying periodically like that, we will choose the right time to buy. For example, let's listen to the situation about the market. We predict that when the government of President Joe Biden signs the $1.9 trillion package, the price of BTC is likely to bounce. We will choose this time to accumulate more BTC for ourselves before the price is likely to increase.

Advantages: With this form, it will be suitable if you are a good observer, know about technical analysis. You can "watch" the low price areas to buy in. Thus, overall, the average price you have to pay to own that coin will be much more optimal.

When to apply DCA tracking strategy: As can be seen, this form is not for new investors. It is aimed at seasoned investors. They are the people who have participated in and partly understand how this market works.

Whatever form you start with, in order for price averaging to work optimally, we'll need some "tricks" to do this. In the next part of the article below, we will discuss this issue in more detail.

6. How to apply price average DCA when investing in Crypto in detail

Step 1: Find and select a potential coin

You might think of top coins like Bitcoin or Ethereum for this storage. Choosing a coin that is said to have potential will depend on your perspective on that coin. It is an investment and you will need to pay more attention to it.

So what kind of coin is considered potential? There are many factors to evaluate, but you can pay attention to a few indicators as follows.

Large-cap: Large-cap coins will somewhat limit the risks of price manipulation in the market. Usually, the coins with the top 10 capitalization will always be prioritized by the majority of investors.

Powerful development team: The development team is the factor to make a project successful or fail. The team may include developers in the form of global open source contributions.

Step 2: Choose the appropriate form of price averaging

As above, I have discussed with each other about two forms of price averaging, the periodic DCA strategy and the tracking DCA strategy. Or you can choose other forms to have the best buying points.

Note that when you have chosen a suitable form, best follow that strategy, avoiding the "plowing in the middle of the road". In addition, another thing you should keep in mind is that you should make statistics, record and track every operation in and out of your orders. This will help you better manage the initial fee you spend to track profit and loss later.

7. Specific examples of how to apply DCA price averaging in crypto

I will give a simulated example for you to better understand the price averaging technique in this section. The context will be as follows:

I choose the form of periodic price averaging. That is, every month I will deduct an amount of 100 USD to invest BTC. By default, I will buy BTC on the 25th of every month with that amount of 100 USD. Let's see, after a year, how your average investment will be.

Every 25 months, I put in 100 USD to buy BTC. Each month spent that much money regardless of the price of BTC at the time. If following the above method, after a year of investment, I have put in a total of $ 1,200 to buy BTC.

After one year, the amount of BTC I own is 0.0910 BTC. If calculated with the current BTC exchange rate, this amount of BTC has a price of 4,285.84 USD.

Thus, compared to the $1,200 capital I spent, based on the monthly averaging strategy, after one year I made a profit of $ 3,085.84. Not a bad investment during this pandemic, right?

Note that in the above example, I have omitted the transfer fee that may arise during the transaction. Interested readers can calculate their own averaging investments at this Web site: https://calculator.for-bitcoin.com/. In addition, if you are a fan of Altcoins, you can do the same and calculate your blueprint at this Web site: https://costavg.com/.

8. 3 points to keep in mind when using the DCA price averaging strategy

#1. Define psychology as Holder, not Trader

However, don't forget that holding also needs a stop. The purpose of investment is to make a profit. So set yourself an investment goal. And you withdraw when you feel you have achieved that goal.

#2. Should follow a fixed strategy

Also, be sure to keep a detailed record of your averaging times. Not only with this form, I recommend applying this form to all transactions in the cryptocurrency market in particular. It will help you control transactions as well as emotional factors that may arise that affect investment decisions.

#3. Prepare capital for price averaging

No matter which form you choose, in the end, the most important factor is still the need for capital. It doesn't matter how little or how much you have. However, you should set aside a suitable budget for that. To make capital investment more effective when combined with price averaging, you should also keep a few things in mind:

Invest with idle money: Idle money is the amount of money you determine you can lose if unlucky your investment fails. Do not bring essential funds to invest. It will create unnecessary pressure on you. And you will very easily have to "sell young rice" to recover that money when needed.

Have an effective capital management plan: You can deduct part of your monthly income for capital average. How much will depend on your arrangement. In addition, if you intend to average capital across many different coins, you should also plan to allocate accordingly. Focus on the coins you have the most confidence in. DCA is absolutely a smart and safe strategy especially for new investors with small capital. Instead of putting all of your capital into one investment, you can split the investment into multiple trades at regular intervals. This way you won't have to wait until you have a huge amount of money to invest.

DCA's regular investments also ensure the safety of your capital even when the market shows signs of going down. For some people, long-term maintenance of an investment during falling prices can seem very intimidating. However, if you sell and lose your investment position when the price is falling, you will most likely miss a lot of opportunities when the market stabilizes and recovers in.

9. Frequently asked questions about DCA in coin investment

In short, the DCA strategy is very easy to apply. But like any strategy, it is not a win-win strategy or a formula to beat the market. Many investors combine DCA with coin portfolio diversification to minimize risk.

Especially in the crypto market, many coin investors fail on DCA due to the following mistakes:

Using DCA Strategies While Leveraging: Margin trading is inherently risky as traders use more than they have. Therefore, this risk is doubled when used in combination with DCA. It is recommended to use DCA only when doing spot trades.

Use DCA strategy with illiquid altcoins: Bitcoin alone, although it is one of the most traded assets in the market with high price volatility, illiquid altcoins are more at risk more risk. These altcoins are sometimes sketchy projects…so thorough research is required when you want to invest in them.

Using DCA on altcoins/BTC: This way you can still profit from most of your experience. But in general, there are two volatility risks to the altcoin/BTC pair. The first is the volatility of the altcoin/BTC pair itself, and the second is the massive volatility of the BTC/USD pair. Therefore, when you buy an altcoin / BTC that is falling in price with the amount of BTC that is depreciating, it is very easy to "lose everything".

Using DCA on crowdsourced coins: For example, memes, coins that have been exaggerated as a joke. These crowdfunding coins should be seen as a factor for diversifying a coin portfolio, not the goal of adopting a DCA strategy.

Should DCA be applied in crypto?

In general, the Bitcoin or cryptocurrency market is both risky and prone to large fluctuations. As such, concentrating money on one price will create greater risk for investors, or can also be a way to generate huge profits. However, this will not help you survive long in the market. The DCA strategy will help you break down your investments, reduce your risk, and give you time to assess the market.

Should DCA be applied to multiple cryptocurrencies?

You should invest in many coins on the market. But the requirement is that these coins must be at the top to avoid the risk of this currency being wiped clean.